Spain, with its Mediterranean climate, rich culture, vibrant cuisine, and attractive cost of living, remains a favorite destination for foreigners looking to establish a second home, invest, or even relocate permanently. If you're thinking about Buying a home in Spain as a foreignerYou've come to the right place! At Grupo Inmocosta, we're experts in the Spanish real estate market and we'll be with you every step of the way through this exciting process.

The reasons are multiple, and go beyond the sun and the beach:

At Grupo Inmocosta, we understand that Buying a home in Spain as a foreigner It's a significant investment and a life decision. That's why we're committed to offering you comprehensive and personalized service:

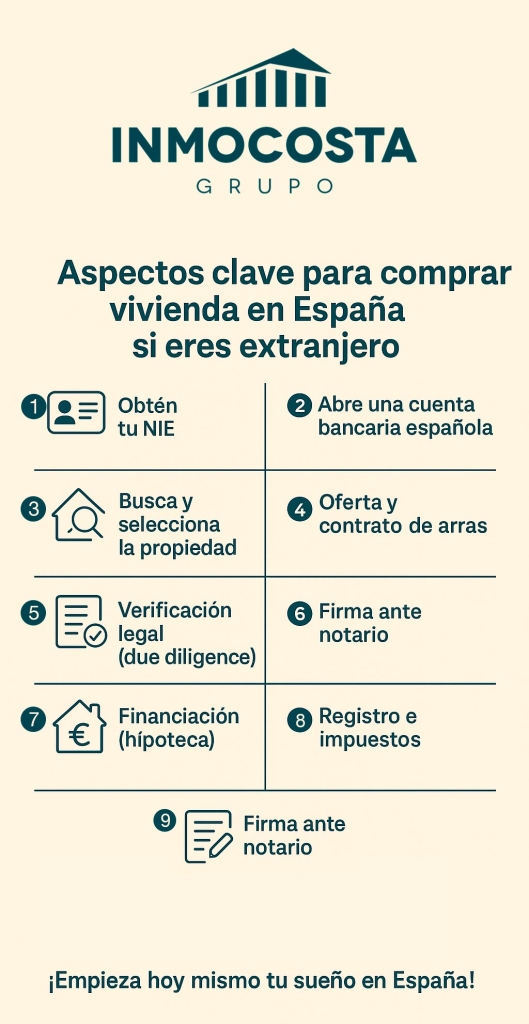

The process of buying a property in Spain It may seem complex, but with the right guidance, it's completely manageable. Here are the most important points:

Obtain your NIE (Foreigner Identification Number): This is the first and most crucial step. The NIE is a tax identification number that is essential for any financial transaction in Spain, including the purchase of a home. You can apply for it at police stations in Spain or at the Spanish embassy/consulate in your country of origin.

Open a Spanish Bank Account: You'll need a Spanish bank account to make payments related to the property purchase, such as deposits, tax payments, and utilities.

Property Search and Selection: This is where Grupo Inmocosta makes the difference. We have a broad portfolio of homes for sale in Spain, from coastal apartments to luxury villas and rural estates. Our agents, knowledgeable about the local market, will help you find the property that fits your needs and budget, in areas such as the Costa Blanca, Costa Cálida, and more.

Offer and Deposit Contract: Once you find the ideal property, you'll make an offer. If it's accepted, a Deposit Contract (or reservation contract) will be signed, which establishes a deposit (usually 10% of the purchase price) to secure the property. This contract also sets a deadline for signing the public deed.

Due Diligence: Before signing the final contract, it's essential to have a thorough property inspection conducted by a real estate attorney (highly recommended for foreigners). This includes:

Financing (Mortgage): If you need financing, Spanish banks offer mortgages to non-residents. It's advisable to explore your options and obtain pre-approval before starting your property search. At Grupo Inmocosta, we can advise you on the best banking options.

Signing of the Public Deed before a Notary: This is the crucial moment. The sale is formalized before a notary public. The buyer, the seller (or their legal representatives), and, preferably, your lawyer will be present. At this point, the remaining purchase price is paid, and you are given the keys.

Property and Tax Registry: After signing, the deed must be registered in the Property Registry. You must also pay the taxes associated with the purchase, which include:

At Grupo Inmocosta, we understand that buying a home in Spain being

foreign It's a significant investment and a life decision. That's why we're committed to offering you comprehensive and personalized service:

Start Your Spanish Dream Today!

Start Your Spanish Dream Today!

Don't let distance or bureaucracy stop you. buy your house in SpainWith Grupo Inmocosta, the process is clear, transparent, and efficient.

Contact Grupo Inmocosta today and let our experts help you find the perfect property and make your dream of living in Spain a reality. We're here to help you every step of the way!

To help you even further on your path to buying a property in SpainWe have compiled the most frequently asked questions that foreign buyers often ask.

No, you do not need to be a resident to buying a home in Spain. However, you will need to obtain a NIE (Foreigner Identification Number) and open a bank account in Spain.

The process may vary, but generally, from the reservation to the signing of the public deed, it can take between 2 and 4 months, depending on the complexity of the transaction, whether you need a mortgage, and the speed with which documents are obtained.

The main taxes are the Property Transfer Tax (ITP) for second-hand properties (between 6% and 10% depending on the autonomous community) or VAT (10%) and Documented Legal Acts (AJD) for new construction. In addition, there are notary and registration fees.

Although it is not mandatory, it is highly recommended hire an independent lawyer specializing in real estate law. He will be in charge of carrying out the due diligence of the property and will protect your interests throughout the process.

Yes, Spanish banks offer mortgages to non-residents, although conditions may vary from those offered to residents. Generally, the financing percentage is lower (around 60-70% of the appraised value).

He NIE It's your Foreigner Identification Number, a tax number essential for any economic transaction in Spain, such as buying a property, opening a bank account, or contracting services.

The Golden Visa It is a residence permit for investors from outside the European Union who make a significant investment in Spain, such as the purchase of a property worth €500,000 or more. It facilitates residency for the investor and their family.

In addition to taxes, you must consider attorney fees, notary and registry fees, and possible appraisal costs if you need a mortgage. In total, these additional expenses usually add up to between 10% and 15% of the purchase price.

By purchasing an apartment or townhouse, you will become a member of a community of ownersYou will be required to pay monthly or quarterly fees for the maintenance of common areas. It's crucial to verify that the seller has no outstanding debts to the community.

Working with a trusted real estate agency As an Inmocosta Group, it's essential. We have in-depth knowledge of the local market, a broad portfolio of properties, and we offer expert advice to help you find the home that best suits your needs.

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.

Para ofrecer las mejores experiencias, nosotros y nuestros socios utilizamos tecnologías como cookies para almacenar y/o acceder a la información del dispositivo. La aceptación de estas tecnologías nos permitirá a nosotros y a nuestros socios procesar datos personales como el comportamiento de navegación o identificaciones únicas (IDs) en este sitio y mostrar anuncios (no-) personalizados. No consentir o retirar el consentimiento, puede afectar negativamente a ciertas características y funciones.

Haz clic a continuación para aceptar lo anterior o realizar elecciones más detalladas. Tus elecciones se aplicarán solo en este sitio. Puedes cambiar tus ajustes en cualquier momento, incluso retirar tu consentimiento, utilizando los botones de la Política de cookies o haciendo clic en el icono de Privacidad situado en la parte inferior de la pantalla.